When compiling this year’s Pizza Power Report, three themes kept appearing again and again: quality ingredients, technology and the youth culture. Consumers are increasingly insisting on the freshest, healthiest ingredients, a trend driven largely by younger segments of consumers, who also demand the highest technology available to facilitate ease of ordering and delivery.

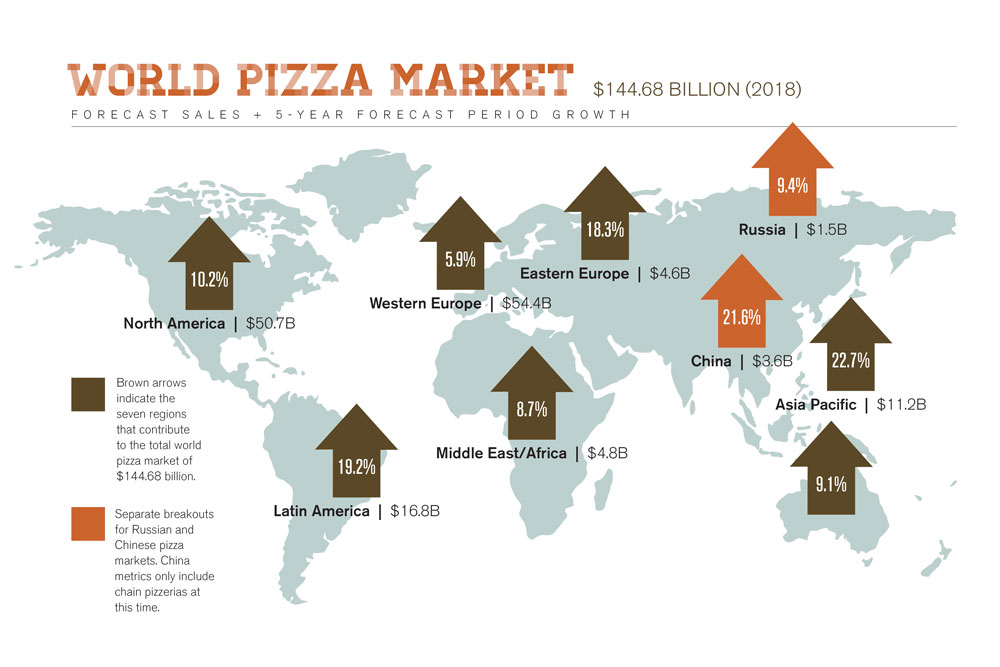

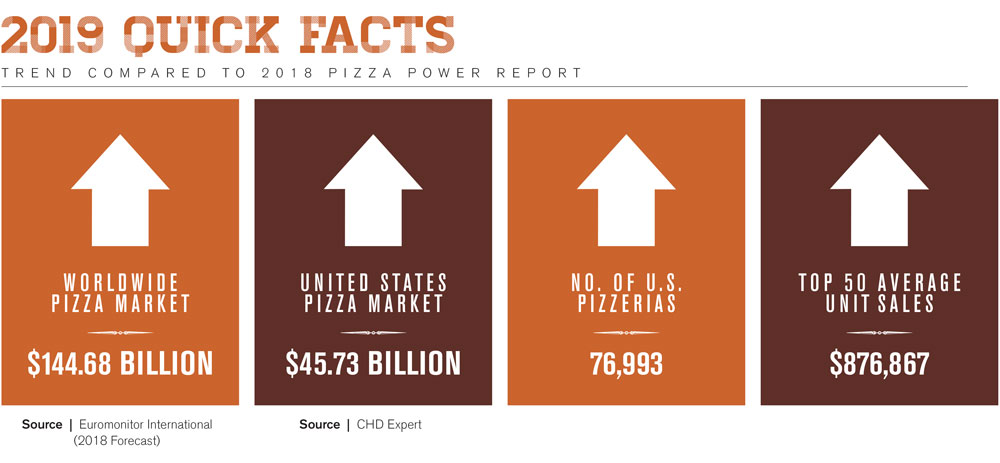

But, despite evolving approaches and consumer demands, the state of the pizza industry is strong. According to a Technomic study, 83% of consumers eat pizza at least once per month. According to PMQ’s 2018 Industry Census, 60.47% of respondents reported an increase in sales over the previous year. Internationally, pizzerias are thriving, with a five-year forecasted growth rate of 10.7%.

Trending Abroad

China: Foreign Chain Invasions

China continues growing, and everyone wants a piece of the pie. PMQ China projects that Pizza Hut will open a whopping 1,000 new units throughout the country in 2019, while Papa John’s and Domino’s are estimated to open 50 new units each. Other projected players include Sazeriya (Japan), Mr. Pizza (South Korea) and Dodo Pizza (Russia), planning to open 100, 50 and 20 new stores, respectively.

Source: Shelly Liu, PMQ China, Beijing, China

Italy: Competition Stays Fierce

In Italy, pizza would perhaps seem to be recession-proof. But, since 2013, 50% of new pizzerias closed their doors within the first five years of opening, according to Unioncamere. Strong competition is cited as the main reason for the high number of closures. Some pizzerias are making themselves more competitive by offering unique kinds of dough and healthy ingredients, though the majority of pizza consumed still follows Italian tradition.

Source: Marianna Iodice, RistoNews.com, Bari, Italy

American Chains Still Conquering the World

Chains may have dwindled domestically, but abroad they are actively expanding. Papa John’s added 146 global units from the 3rd quarter of 2017 to 2018. In the same period, Domino’s added 232 global units, and Yum! Brands added 192 Pizza Hut units worldwide. Domino’s has its strongest international presence in Australia and India, but it has also recently opened stores in Europe, notably in Scandinavia and Italy. This year, Papa John’s expanded its presence in Central Asia and Eastern Europe with new stores in Kazakhstan, Kyrgyzstan and Poland. Pizza Hut will be developing Latin America, the Caribbean and select countries of Europe in a landmark deal with Telepizza, while also investing heavily in the Chinese market.

Russia: Speed Is King

Par-baked crusts are swiftly replacing fresh or frozen dough for their ease of transport across long distances and improved shelf life. The need for consistency and speed reflects a market that is high-volume-driven. Pinsa par-baked crusts are also making waves for their ease of use and innovation in health benefits.

Source: Elena Shirokova, hotzilla.club, Moscow, Russia

Sweden: Pizza Expands to Gourmet

In contrast to Russia, Sweden is shedding its long-held belief that pizza is only for fast food consumption. Pizza is now appearing in upscale restaurants and other areas it was never seen in before, such as pubs, resorts and airports. Accordingly, pizza competitions and education events are also on the rise in Sweden.

Source: Mikael Lundgren, Sveba-Dahlen, Fristad, Sweden

Brazil: Refining the Market

Much like the United States, Brazil experienced a wave of Italian immigration at the beginning of the 20th century. From there, pizza culture was born, but it hasn’t been until recent years that the market demanded highly skilled pizza makers. Today, pizza makers are putting effort into education to understand different ways to make dough and select toppings wisely to promote both health and the culinary arts.

Source: Carlos Zoppetti, ConPizza, São Paulo, Brazil

Domino’s Dominates

For the first time, Domino’s overtook perennial heavyweight Pizza Hut in total sales. According to DominosPizza.com, global retail sales grew 8.3%, domestic same-store sales grew 6.3%, and international same-store sales grew 3.3%. The chain experienced a global net store growth of 232 units in the third quarter of 2018, according to a press release by dominos.com.

Domino’s has been enjoying a consistent growth pattern for the past several years. A January 2018 article in Forbes states that after hitting an all-time low in 2008, when its stocks sold for $3 per share, Domino’s now commands a price of $266. In that article, Kelly Garcia, Domino’s SVP of e-commerce development and emerging technologies, states that execs had to start thinking of themselves as heading up an “e-commerce company that happens to sell pizza.” Kelly says that Domino’s success is due to two critical factors—fundamentals and “surprise and delight.” Domino’s correctly identified that the industry was moving to mobile, which contributed to half of their digital sales, while digital sales now make up the majority of overall sales.

“Surprise and delight,” the second element in Domino’s plan, included implementing a strategy of enabling customers to order from any of their favorite devices. This led to development of its new ordering platform, Domino’s AnyWare, which allows customers to order through any number of devices, including in-home assistants such as Amazon Echo, smart TVs, smart watches, and social media platforms. Meanwhile, the emphasis on new platforms attracted top talent to work on product development. Garcia also notes that Domino’s loyalty program rewards its best customers and keeps them away from the competition.

Rethinking Fast Casual

|

|

Ravenous customers enjoy a delectable pie at MOD Pizza. |

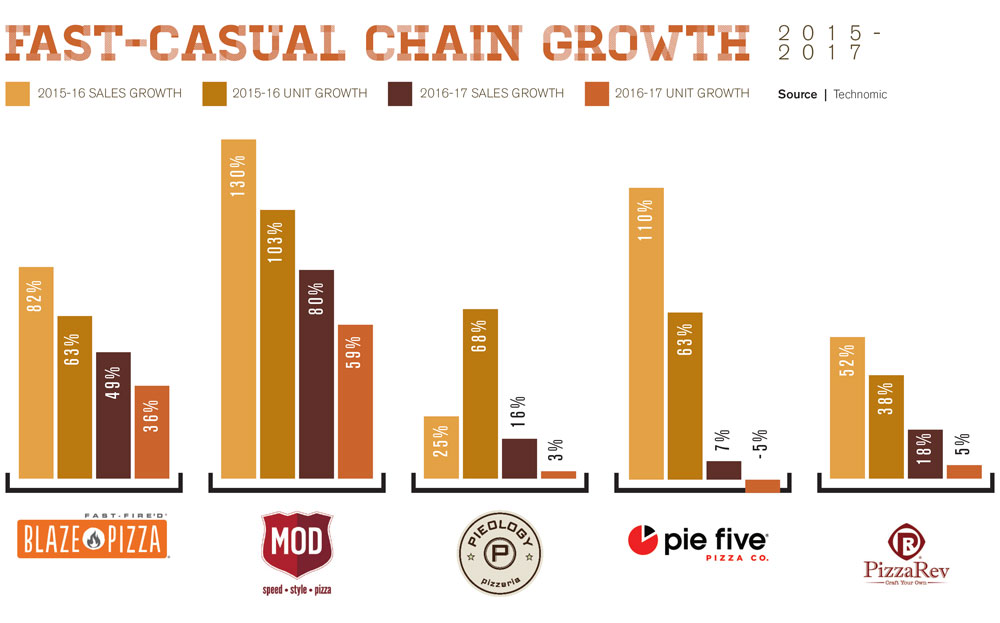

Although growth among fast-casual restaurants slowed significantly from 2016, this category continues to be an important and growing segment of the pizza industry. A Technomic study found that 28% of consumers frequent fast-casual establishments (visiting at least once per month), putting them on track with full-service pizzeria restaurants. Fast-casual pizzerias are also expanding their menus, offering dishes such as chicken wings, sandwiches and salads.

QSR reported in May 2018 that a survey of 1,000 consumers by AlixPartners, a global consulting firm, indicated that only 20% of millennials say they intend to visit fast-casual establishments twice weekly or more over the next year, compared with 24% in the 2017 survey. The same survey found that just 32% of diners in this year’s survey preferred fast-casual for lunch, a 5% drop from AlixPartners’ survey in 2017. At the same time, fast food was the preferred lunch destination by 35% of respondents in this year’s survey, an increase of 5% from the previous year.

Diane Kelter, a leading analyst in the foodservice sector, reflected on fast-casual changes in a Mintel report. “Even as things change, they still remain the same,” Kelter says. “The concept of quality food at an affordable price that launched the fast-casual segment has remained a key association. However, as dining habits shift and the landscape gets more competitive, fast casuals look beyond what worked in the past and focus on what lies ahead, including more premium beverages and automation, as well as the showcasing of specialty concepts on a mainstream stage.”

Labor Day

Labor costs and shortages remained a frequent topic of discussion in 2018. With many municipalities raising their minimum wages, combined with a depleted labor force due to a good economy, many pizzeria owners struggled to keep their kitchens staffed. Compound this with stagnant pizza prices and a low unemployment rate, and finding good workers can be difficult.

A CNN Business report from December 2017 reported an increase in minimum wages in 18 states and 20 cities, according to figures from the National Employment Law Project. The highest raises were reported in Washington’s Seattle-Tacoma area, with minimum wages for hospitality and transportation workers at $15.64 per hour.

Lenny Rago, co-owner of Panino’s in Chicago, believes that minimum wage increases necessitate raising menu prices. “I’m totally fine with the minimum wage increase, as long as the consumer is willing to pay a little more.”

An August 2018 article in Nation’s Restaurant News reported on a recent survey, called “Staffing Concerns in Restaurant Operations,” that revealed 67% of operators cited increased competition for workers as a key driver in rising costs. Kevin Ozan, McDonald’s Corp.’s chief financial officer, said in the article, “It’s a tight labor market out there. Labor staffing is a challenge, both for us and the franchisees. But that’s the industry, so I don’t know that we have it any worse than anybody else.” Turnover was also cited in the survey as a challenge: A full 46% of respondents said turnover increased either “significantly” or “somewhat” over the past year (43% said their turnover rates remained unchanged, while 10% said turnover decreased somewhat or significantly).

Freeze Warning |

| The frozen pizza/take-and-bake market growth continues to stay flat, virtually unchanged from 2016. About one-quarter (26%) of consumers say they enjoy frozen pizza “less than once a month,” according to a Technomic survey. Bruce Irving of Smart Pizza Marketing believes that the consumer demand for healthier options is driving the demand for local pizzas vs. frozen options.

Marla Topliff, president of Rosati’s Pizza and chairman of the National Restaurant Association’s Pizzeria Council, meanwhile, adds that it’s tough to recreate a pizzeria-quality pie at home with a conventional home oven. “You could buy a pizza with the same ingredients in a grocery store, but you can’t cook it the same way, so they don’t have the same flavor,” she explains. “It’s so easy to get delivery these days, customers don’t need to get pizzas at a grocery store.” |

And, since many pizzerias seek entry-level workers, we see the youth movement having an effect on the pizza industry when it comes to employment. A September 2018 article in Nation’s Restaurant News revealed data from a recent survey of 1,600 Gen Zers and millennials conducted by the National Restaurant Association Educational Foundation (NRAEF) and the Center for Generational Kinetics. The study suggests almost 50% of Gen Z workers desire recognition, with some sort of weekly feedback, while 47% indicated a desire to have a mentor. In the article, Rob Gifford, NRAEF executive vice president, offered tips for recruiting and hiring younger employees: “Keep applications simple, user-friendly and easy to complete. Rely on current workers to recruit candidates via word-of-mouth, and maintain the restaurant’s reputation across all media channels.”

Rago believes that Gen Zers and millennials also have different expectations for the workplace schedule and environment. “They are trying to dictate their schedule to you, instead of being told when to work,” he says. “They’d rather work at an Uber or DoorDash, where they can make their own hours and do what they want, when they want. They’re not willing to take on jobs that require them to be there every week, with bosses telling them what to do.”

Mike’s Pizzeria, a chain of 29 restaurants based in Albany, New York, has had to increase its prices to accommodate for the rising minimum wage in that state, according to the Albany Business Review. Owner Mike Harvard told the magazine, “We couldn’t compete price-wise with the local pizzeria, because we have to spend more on payroll. Therefore, we have to charge more for pizza, so it kind of hurt. We lost sales because we had to raise our prices, and then raising prices drops revenue down, so it’s a tough situation.”

Meanwhile, Bruce Irving, founder of Smart Pizza Marketing based in Boston, believes there’s a “help crisis” in our industry—and that prices should keep up with rising costs. “We need to get past the perception that pizza costs $10—if you can feed a family of four with one pizza, that pizza should be $20,” he says. “There’s no way you can pay a dishwasher or a cashier $15 an hour, and your manager $20 to $25 an hour, if you charge $10 to $15 for a pizza.”

Discerning Diners

Thanks in part to the increasing popularity of regional pizza styles (think Neapolitan, Roman, Sicilian, Detroit and others), pizza consumers are growing more educated about the individual components of pizza. Hence, owners will need to promote their quality pizza ingredients (such as Italian flour or local produce) to boost their product’s image of authenticity. While consumers still rate overall taste as the most important factor when ordering pizza, 44% of consumers rated “fresh, high-quality ingredients” and “best crust” as deciding factors—up from 40% in 2016, according to a Technomic study. The same study reported that 49% of consumers indicate they would like pizza establishments to offer “more authentic” pizzas.

Irving feels that the increased sophistication of the pizza diner is a plus for independent pizzerias. “They do care about their ingredients,” Irving notes. “They don’t have one set style. They can mix and match and create new menu options, which is what people want.” And diners, due in part to social media platforms such as Facebook and Instagram, are posting photos of a growing number of regional pie types (such as Neapolitan or Detroit-style), contributing to the increase in their popularity. Also, because quality is important among younger customers, the independent operator has an advantage. “The younger generation wants to know what’s in their food, and that’s a great opportunity for independents to dominate their market, because they can do that,” Irving explains. “They’re not set in their ways. They can be nimble. If something doesn’t work, stop doing it. If it is working, do it more!”

Don’t Wait for the Dinner Bell

Although dinner still dominates the pizza industry, other dayparts, such as lunch and breakfast, have gained traction. According to a Technomic consumer survey, breakfast is the fastest-growing daypart in the restaurant industry. Egg and ham pizzas for breakfast are gaining popularity, with 17% of “super heavy” pizza consumers reporting they have eaten pizza at breakfast, according to a Technomic study.

Even 7-Eleven introduced a new breakfast pizza to their food lineup in 2018, and market testing at select 7-Eleven stores revealed that it was the second highest-selling pizza.

In fact, nutritionist Chelsey Amer told The Daily Meal in January that pizza isn’t necessarily an unhealthy way to kick off your morning. “You may be surprised to find out that an average slice of pizza and a bowl of cereal with whole milk contain nearly the same amount of calories,” Amer said. “However, pizza packs a much larger protein punch, which will keep you full and boost satiety throughout the morning. Plus, a slice of pizza contains more fat and much less sugar than most cold cereals, so you will not experience a quick sugar crash.”

“Breakfast pizzas have become very popular,” Marla Topliff, president of Rosati’s Pizza and chairman of the National Restaurant Association’s Pizzeria Council, adds. “It’s not that hard to make a breakfast pizza. You can put anything on a pie. Breakfast has always been a big daypart, just not typically for outlets like us. Fast-casual, five-minute pizzas have the lunch category covered. People want to be able to get in and get out. Dayparts have become a big factor and a booming trend. Everybody’s trying to capture a little of each of those. When we’re trying to get ready for a big football game on a Sunday, we’ll open our stores early and add a breakfast pizza in a lot of our pubs to capture that crowd, because that’s what they’re looking for.”

However, pizzeria owners should be cautious about adding a breakfast pizza to the menu without the proper product development. “I don’t think you should do breakfast pizza if it’s not what you’re good at,” Irving says. “Are 40 people a week asking you to open for breakfast? If they’re not, don’t just open for breakfast just because you think you might be able to grow your sales.”

|

|

Bruno, the robotic pizza-making arm from Zume Pizza. For more info, read our cover story on Zume in the June/July 2017 issue of PMQ Pizza Magazine. |

Technology Leads the Way

When futurists of the 1950s speculated about 21st-century science and technology, they gave little thought to pizza delivery. But leading chains like Domino’s and Pizza Hut, along with up-and-coming companies like Zume Pizza, are turning science fiction into reality for the restaurant industry. Pizzerias are constantly working to find the next technological development that will make ordering and delivering pizzas quicker and easier for the consumer. However, this puts pressure on smaller independent pizzerias, which may lack the capital to invest in such new technologies, to keep up. A full 43% of pizza customers say they find online ordering and tracking technologies “appealing or extremely appealing,” according to a Technomic study, while the same study found that 24% of consumers felt similarly about pizzas that can be ordered from a smart TV.

But how do they feel about robots making their pies? Companies like Zume Pizza, a Mountain View, California-based startup with a so-called “cobot” culture—humans and robots working side by side in the kitchen—hope to answer that question. Zume, which was featured in PMQ’s June-July 2017 issue, earned a new round of funding for $375 million last fall from a single investor, SoftBank Vision Fund. The cash injection reportedly raised Zume’s valuation to roughly $2.25 billion, according to The Wall Street Journal—not too shabby for a company that presently delivers pizzas only in the San Francisco Bay area. Co-founded by Julia Collins and Alex Garden, Zume uses a robot-enabled assembly line to prep and par-bake pizzas, plus predictive algorithms that forecast where pizza orders will come from and what types will be ordered. The par-baked pizzas are then loaded onto huge delivery trucks equipped with refrigeration units and dozens of computerized ovens; as the truck cruises a predetermined delivery area, human employees pop the pies into the ovens for the finishing bake when an order comes in and deliver them, fresh and piping-hot, to the customer’s door.

Other chains have taken note of Zume’s revolutionary model. Pizza Hut, in collaboration with Toyota, is working on its own version, the Tundra PIE Pro, still in the prototype stage. The setup utilizes a rebuilt Tundra SR5, with par-baked pies stored in mini fridges, a pair of robotic arms and a conveyor oven. One robot arm removes the pie from the fridge and places it on the conveyor oven. The pizza emerges, fully baked, on the other side, where a second robot arm transfers it to a cutting board, slices it into six pieces, places it in a pizza box, and closes the box.

Pizza Hut and Toyota are also developing a self-driving delivery vehicle, called the e-Palette, with a working version set to debut at the 2020 Olympics in Japan. Meanwhile, Domino’s has been testing its own self-driving delivery car, a tricked-out Ford Fusion Hybrid, in select markets, including Ann Arbor, Michigan, and Miami.

Even Little Caesars has gotten into the act, receiving a patent in March for its own pizza making robot. The chain also rolled out its first Pizza Portal, described as “the first heated, self-service mobile-order pickup station in the quick-service restaurant industry.” Customers download an app, prepay for their food on a mobile device, and receive a three-digit PIN or QR code. The customer can then go to the Pizza Portal at the store and input their PIN or scan their QR code to open a secured compartment in the portal, retrieving their pizza and skipping the line—no human interaction required.

Breakthroughs in foodservice automation aren’t limited to the pizza industry. Pasadena, California-based Miso Robotics introduced Flippy, an “autonomous robotic kitchen assistant,” earlier this year in Los Angeles. Flippy, which wowed customers at a CaliBurger location in Pasadena and in a food stand at Dodger Stadium, can flip burgers and place them on buns, and operate fryer baskets.

Topliff says that pizzeria owners shouldn’t lose sight of the big picture. “I think technology is a wonderful thing and is helping our industry grow to a great extent, but I also feel that, at some point, the personal touch is going to get lost in all this technology,” she says. “I still think nothing beats being able to talk to your customers and have face-to-face time with them.”

But technology still offers cost-cutting advantages to pizzeria owners, Topliff admits. “During these times when the price of labor is getting so high, things like kiosk ordering and mobile ordering have taken a giant leap. It’s less expensive for a store owner, especially an independent, to be able to keep business going. Technology is something we all have to keep an eye on.”

Health Care

Diners are increasingly looking for healthier options at the restaurant. According to a Technomic study, 25% of consumers indicated they “would eat pizza more often if there were healthier options available,” with young consumers, women, and “super heavy” pizza eaters being most interested. According to PMQ’s 2018 Pizza Industry Census, 64.45% of respondents stated they offer a gluten-free crust, and 23.92% reported offering a vegan pizza.

Keto pizza has also gained popularity. As reported in Liz Barrett Foster’s article on the trend, published in the November issue of PMQ, Ron Mathews, owner of Rockstar Pizza in Brownsburg, Indiana, began offering keto-friendly menu items this year. “I’m having a hard time just keeping up with the demand,” Mathews says. “We’re selling a minimum of 100 keto pizzas on Saturdays, which is when we promote the offering.” Mathews even began offering keto sandwiches, which also proved popular.

|

| View our coverage of keto pizza in our Past Issues (November 2018) section at pmq.com. |

Rago says customers are also demanding higher-quality ingredients. “Quality ingredients help your product brand better,” he explains. “You’ll sell a lot more if you’re using quality ingredients, because people are starting to be aware of what’s going into food.” However, he adds, when adding these high-quality ingredients, operators must make sure to price their menu items accordingly.

Meanwhile, customers with special dietary needs, such as vegan or gluten-free, also expect various options at their favorite pizzerias. “People are just much more aware of what they are eating and putting into their bodies,” Irving says. “My daughter has an intolerance to gluten. If a pizzeria doesn’t offer some sort of gluten-free option, it’s probably not one we will go to. Do some research and explore new menu items; have at least one or two alternative options so you can accommodate the whole family.”

Topliff agrees that today’s consumers have become more health-conscious. “With the advent of menu labeling, everybody knows exactly what you’re putting into your food,” she says. “You’re obligated to source the best ingredients, the freshest ingredients, because they’re being looked at more than ever.”

Another ingredient trend has been the uptick in plant-based and vegan ingredients. Domino’s Australia added three vegan pies to its menu, in addition to vegan garlic bread, according to a January 2018 article on livekindly.co. Domino’s Australia stated, “We have been overwhelmed by the popularity of our vegan cheese…We’ve received great feedback about having vegan cheese, and it will stay on the menu.”

The Youth Movement

At the close of 2018, there is an entire generation of consumers who never knew a world without computers, and many of them have no memory of a world without cell phones. Young customers tend to do anything and everything they can on their smartphones or online, whether it is ordering a ride via Uber or ordering a pizza. The convenience of not having to interact with other people is also an incentive to them.

At the same time, a Technomic study found pizza to be most popular among younger consumers (Gen Zers and millennials), with pizza consumption frequency lessening with age. According to a poll by Ellios.com, 40% of millennials think pizza is “the best food in the world.”

In an interview for an August 2018 article in the online publication diginomica, Papa John’s CEO Steve Richie discussed the importance of the younger generations. “Our focus on digital efforts is clearly to make certain that we are appealing to younger audiences, which will be the future of the overall business,” he said. “This brand reputational work is very, very critical to moving the overall comp sales forward while we’re solving for differentiations in messaging and the value perception and the introduction of all the new technology pieces.”

A November 2018 study by eMarketer Retail found that 36% of U.S. internet users ordered restaurant delivery in the past year, the majority of which were those under 35. The survey found that younger users have higher adoption rates and tend to use delivery services more frequently.

Irving notes that younger pizza consumers want online ordering, as well as information on your ingredients. “You have to recognize that and adapt your business,” he says. “If you don’t change now, it might not affect your business today, but five years from now, you’re going to look back and say, ‘I wish I had online ordering then, because now everybody else has it.’”

Topliff echoes the demands of those who prefer to do things right from their computer or phone for ease and convenience. But she also identifies an unexpected upside to online ordering: privacy. “There is a tendency to order more online, because no one is watching what you’re ordering,” she explains. “You have the ability to order in the privacy of your own home and by yourself. But some people still prefer to order in person, so you have to be prepared to go in any direction that is going to be most convenient and make your customers the happiest.”

Third-Party Services

Third-party delivery and ordering services have been game-changers in the pizza industry. For the first time, restaurateurs have the option of not hiring drivers and paying costly insurance bills for the luxury of delivering their product. However, these services come at their own cost.

A June 2018 Morning Consult poll reported that “31% of U.S. adults order delivery at least somewhat often, and 67% ‘hardly ever’ or ‘never’ order in.” The study also indicated that 82% said they prefer to order directly from a restaurant, while only 13% utilize a third-party delivery service; 26% stated “quality of the food delivered” was the deciding factor in choosing a third-party delivery service. According to PMQ’s 2018 Pizza Industry Census, 67.46% of respondents reported not utilizing a third-party delivery service.

Rago believes that the convenience of third-party services does not necessarily offset the increased costs of utilizing those services. “I know it’s convenient, but they’re not money-conscious,” Rago says. “When you use those third-party companies, most of the time customers are paying an inflated rate or surcharge. Bottom line is, it’s costing the millennial more money without them necessarily realizing it.”

Topliff believes that, when evaluating a third-party service, operators must examine the seamlessness of the delivery process: Are they delivering in the right packaging? Are the pizzas actually arriving the way they should? “We’ve had our own deliveries and drivers for the 50 years that we’ve been in business,” Topliff says. “We still have the availability for things like UberEats and many of the third-party delivery services, only because that’s where some of our customers are. It seems like a lot of the millennials prefer to skip having that one-on-one contact and just want to be able to do it right from their computer, so we have to be in both places.”

Leveraging Loyalty

Loyalty programs have been around for decades and remain hugely popular to this day, including for pizzerias.

According to PMQ’s 2018 Pizza Industry Census, 41.71% of respondents reported utilizing a loyalty program. In a 2016 Forrester Data Consumer Technographics North American Retail and Travel Survey, 60% of loyalty customers said the programs influence where they make purchases, and 48% said loyalty programs influence what they buy.

In the same survey, 64% of U.S. online adults who belong to any customer loyalty program, and who regularly participate in most of the programs they join, said the programs make them feel more loyal to the brand or company, compared with 42% who participate in just a few programs and 19% who rarely participate.

“I think every business should have loyalty programs,” Irving says. “If you can get someone to download your app, you can get them to order much more frequently through that app, because they are now a loyal customer. It’s something every business should look at.”

“You can’t be in business without a loyalty program these days,” Topliff agrees. “Everybody’s looking for them. We have coupons on the side of our boxes that say ‘Buy 12, get one free.’ We have it on every website and homepage and every possible social media place we can put it: If you’re part of our loyalty program, you’ll get something for free. These days, in these economic times, people are looking for that.”

In a Nutshell

Ultimately, despite all of the challenges today’s pizzeria owner faces, Topliff offers a positive summation of the state of the pizza industry. “Pizza has been one of the staples of the industry for the last hundred years,” she says. “There have been recessions, but pizza always seems to do well even during those times, because we’re the one food that families can depend on—that can feed a family for a fairly decent price, that helps celebrate football games and birthdays and kids’ parties. It’s always been the biggest percentage of the National Restaurant Association and the International Franchise Association.”

And, if there’s one more trend that doesn’t look to be slowing, it’s the increased focus on technology. Looking ahead to 2019, remain on the lookout for new innovations, whether it’s a new ordering app, a piece of equipment that can lower your labor costs, or an upgraded POS system. History shows that those who fail to adopt new technologies may be left behind, especially given the youth market’s affinity for all things high-tech. At the same time, don’t forget that using healthy, quality ingredients will always be a core component of any successful pizzeria—though times may be a-changing, some consumer demands will always remain in fashion.