Hamburgers may still be America’s No. 1 restaurant food, but make no mistake: Pizza is a whole lot cooler. When pop superstar Katy Perry got hungry in the middle of a concert in Kansas City, Missouri, this summer, she didn’t dial up the local Wendy’s. She ordered a pepperoni pie from hometown favorite Minsky’s Pizza (minskys.com) and brought a young fan onstage to share a slice. Jimmy Fallon took a similar tack in March when he surprised his Tonight Show guest Tina Fey with a cheesy on-air treat—a carryout order from the legendary Pica’s Pizza (picas-restaurant.com) in Upper Darby, Pennsylvania.

Celebrities and actors from Ellen DeGeneres to Steve Carell and Jennifer Garner have been making headlines all year by ordering pizza for their audiences and for each other. And independent pizzerias, such as the Original Barone’s Famous Italian Restaurant (baronesfamousitalian.com), and small chains like Big Mama’s and Papa’s (bigmamaspizza.com), both based in Los Angeles, have been getting most of the love. Even former child star Macaulay Culkin has gotten into the act, touring the country with a novelty band that puts a Weird Al-style pizza twist on old Velvet Underground tunes. Eat your heart out, Whataburger!

Considering that pizza has become such a cultural touchstone from coast to coast, it’s no surprise that U.S. pizza restaurant sales grew a little bit over the past year even as the economy continued to drag. All of the industry’s leading research firms—including Technomic, CHD Expert, Mintel, Euromonitor and the National Restaurant Association (NRA)—agree that key sales figures are up, although challenges await us in 2015. Once again, we’ll crunch the numbers to uncover key sales figures for independents and chains alike, and we’ll also share insights from leading operators and researchers about noteworthy trends that will impact our readers in 2015. Let’s get started!

Sales Figures and Store Counts

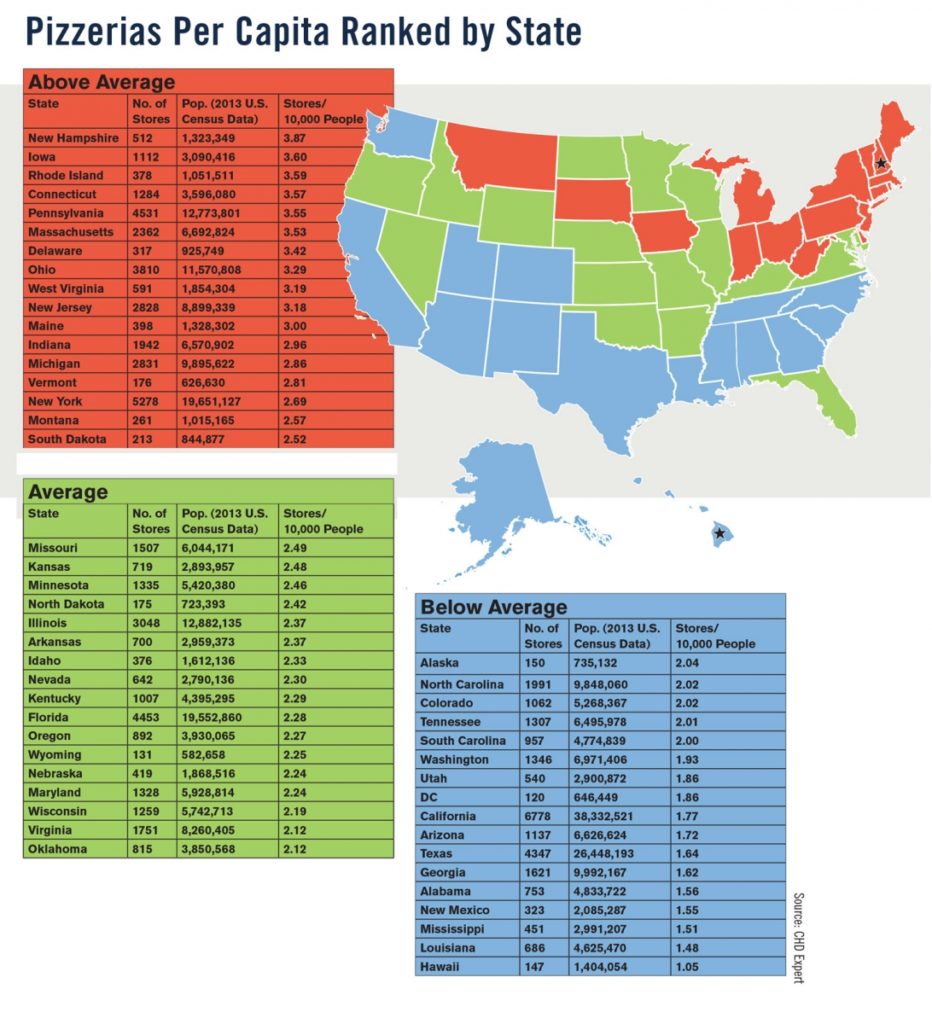

It’s safe to say the pizza restaurant industry has entered the mature stage of its life cycle. Many towns and cities have reached the limit of pizza restaurants that their populations can support. That makes it harder for operators to open new stores and for new operators to get into the business. It also means that increasing sales-per-unit—rather than opening new stores—is a key driver of industry revenue.

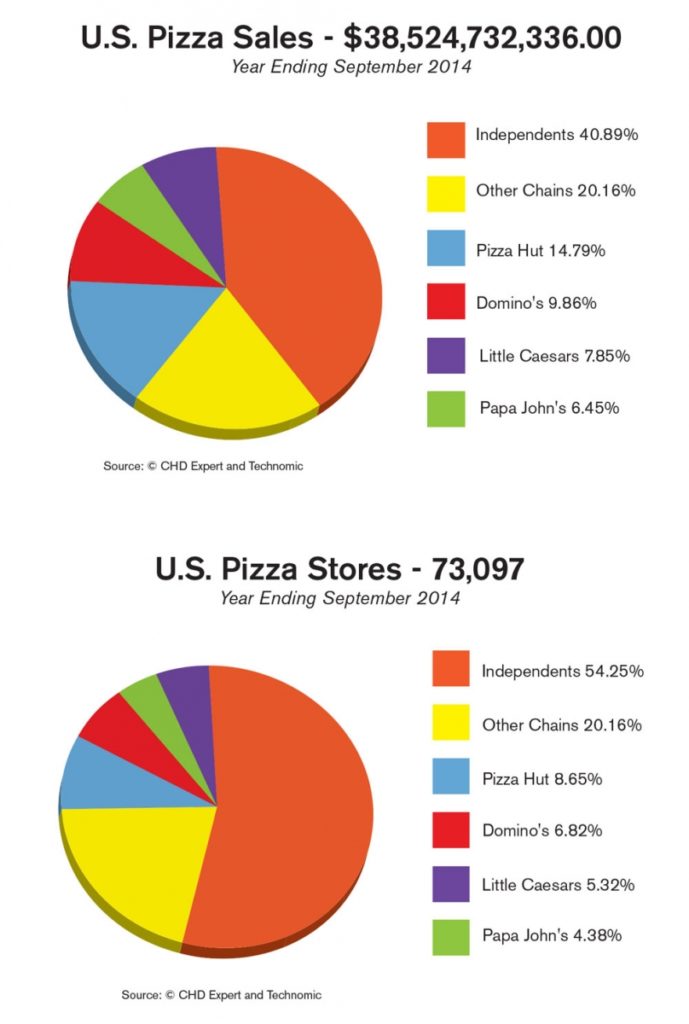

Having said that, pizza sales in the States still rose over the past year, reaching $38,524,732,336 by the year ending September 30, 2014, according to data from CHD Expert. That’s a 3.08% increase over PMQ’s estimated sales figure of $37,375,108,000 for the industry in 2013. (See sidebar on this page about last year’s estimated sales figures.)

Meanwhile, total pizza store counts in the U.S. jumped by more than 2% over the past year, and the majority of that increase came from independent operators. For the year ending September 30, the total number of stores came to 73,097, a jump of 1,710 from last year’s total store count of 71,387. Additionally, CHD Expert found that more new stores opened this year, with 4,107 new units compared to 2013’s figure of 3,981 new stores. Meanwhile, far fewer pizza shops closed their doors—only 1,181 units shut down in 2014, while 2013 saw closure of 2,038 stores.

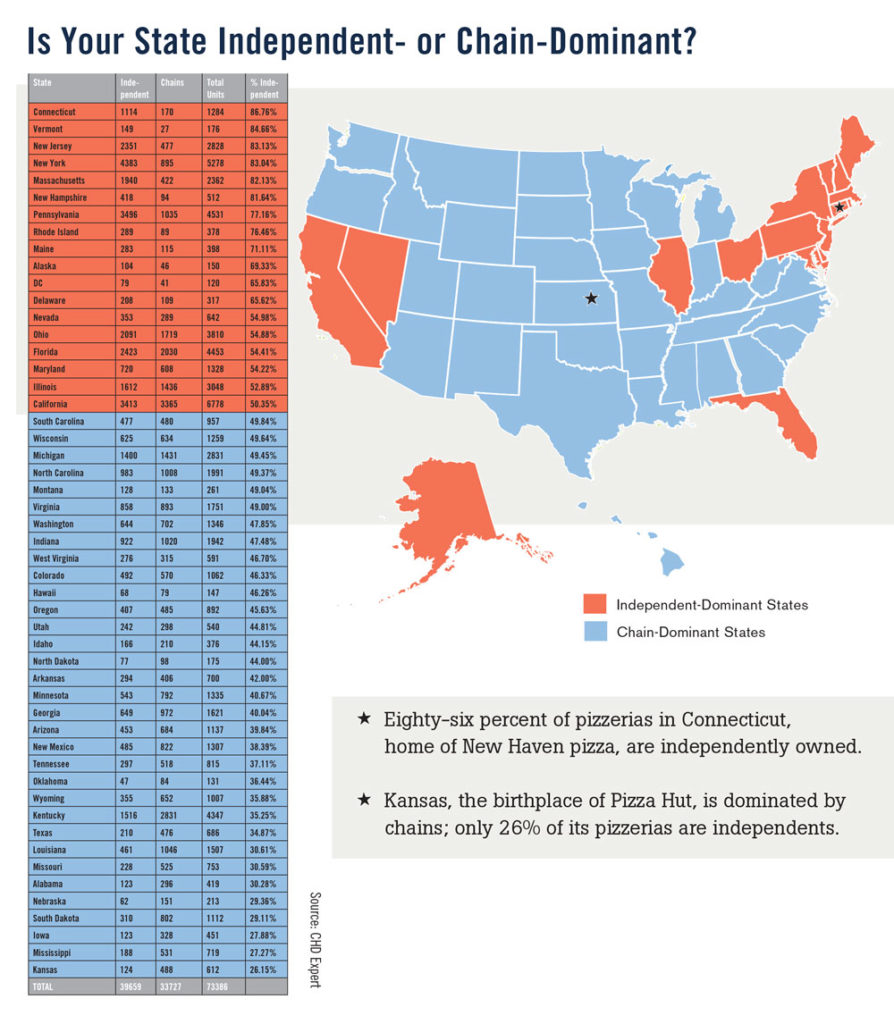

Independent pizza operations now account for 54.3% of all pizzerias in the country, up 1.1% from the 2013 figure of 53.2%. About 45.7% are chains, compared to 47% in the previous year. (For the record, we always define independents as pizzerias with fewer than 10 units; any company with more than 10 stores is considered a chain.) Even so, chains accounted for the majority of industry sales, with $22,768,432,380 in 2014, compared to $21,425,686,281 the previous year, CHD Expert reports. Independent restaurants accounted for $15,756,299,956 this past year, up from CHD Expert’s estimate of $14,481,887,024 for 2013.

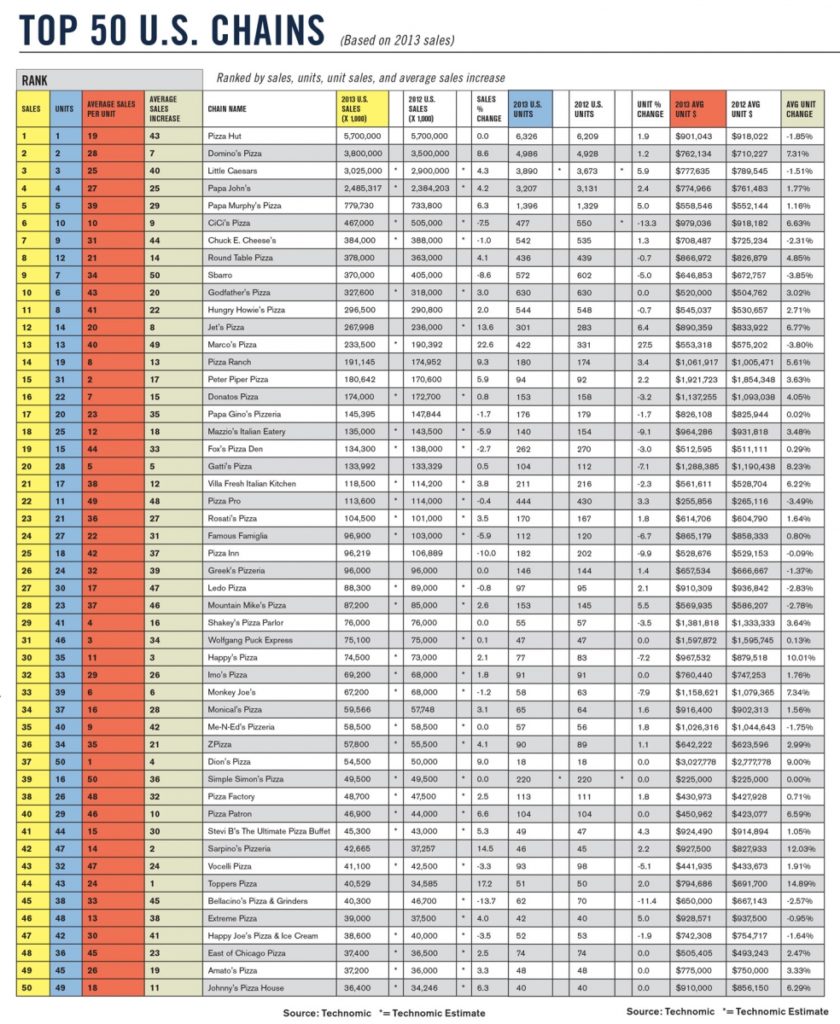

Technomic, meanwhile, reported data for the top 50 pizzeria chains in 2013 relative to 2012. Again, the numbers were up in 2013, totaling $21,546,298,000, with per-unit sales averaging $772,130 (among 27,905 units). Compare that to 2012, when the top 50 chains’ sales equaled $20,915,245,000 with per-unit averages of $721,995 (among 27,414 units). That means the top 50 experienced a total sales increase of $631,053,000 while store counts increased by a total of 491 units.

The Big Freeze

Sales for frozen pizza seem to have, well, frozen, over the past five years, and no thaw is expected soon. According to Mintel, sales grew by only 0.2% in 2014 for a total of $5.5 billion and will likely remain flat into 2019. Mintel blames stagnant sales on a somewhat improved economy as “more customers opt for costlier restaurant/takeout/delivery pizza over more affordable frozen pizza.” Not surprisingly, two-thirds of respondents to a Mintel survey said that restaurant pizza tastes better than the store-bought variety. Respondents between the ages of 18 and 34 and those with children were more likely to eat frozen pizza, but that demographic isn’t forecast to grow as quickly as the general population over the next five years.

Nestlé S.A. dominated the retail pizza business with a market share of roughly 40% and an estimated $2 billion in sales through the year ending February 13, 2014. Its top brands include DiGiorno, Tombstone and CPK (California Pizza Kitchen). Nestlé rolled out its new Digiorno’s Pizzeria! line during this period, achieving $89 million in first-year sales. Like other DiGiorno offerings, the Pizzeria! brand attempts to mimic restaurant-style pizza, demonstrating the ongoing appeal of authentic and fresh-made pies.

Rounding out the big three, Schwan Food Company (makers of Red Baron, Freschetta and Tony’s) reported $877 million in sales this past year, while General Mills (Totino’s and Jeno’s) followed with $424 million in sales.

Overall Restaurant Growth

For the fifth straight year, the restaurant industry in general showed modest growth, with sales expected to hit another record high in 2014, according to the NRA’s 2014 Restaurant Industry Forecast. The NRA credits a stronger economy and “historically high levels of pent-up demand among consumers” for the boost, as overall restaurant sales are projected to reach $683.4 billion in 2014, an increase of 3.6% from 2013. Even so, the NRA forecast says, “The gains remain below what would be expected during a normal post-recession period.”

The restaurant industry remains the nation’s second-largest private-sector employer, with 13.5 million people working in the business. Restaurants are projected to add jobs at a national rate of 2.8% this year. Over the next 10 years, the fastest restaurant job growth is projected to occur in Arizona with a rate of 15.6%, followed by Texas with 15.3% and Florida with 15%. Nevada (14.7%) and Georgia (14.4%) round out the top five states with the fastest restaurant job growth.

Fast-Casual Speeds Up

|

|

Sbarro jumped into the burgeoning fast-casual segment last year when it opened two Pizza Cucinova locations in Columbus, Ohio. Photo courtesy Pizza Cucinova. |

The fast-casual pizza boom—based on the Chipotle Mexican Grill/Subway service model—was the talk of the industry in 2013, and the buzz has only grown louder this year. It’s already mushroomed into a $21 billion-per-year industry, according to NPD Group. According to Technomic, 55% of pizza consumers now purchase fast-casual pizza at least once per month, and franchised eateries based on the model are multiplying across the landscape. In fact, a forecast from Telsey Advisory Group this fall predicted that as many as 2,000 fast-casual pizza stores could open over the next five years.

As we reported last year, a couple of long-established pizza giants have helped spur the growth, with Pizza Inn Holdings launching Dallas-based Pie Five Pizza (piefivepizza.com) and Sbarro opening Pizza Cucinova (pizzacucinova.com) in Columbus, Ohio. But restaurant chains with no previous pizza affiliation have also joined the movement—Buffalo Wild Wings owns a stake in PizzaRev (pizzarev.com), headquartered in Los Angeles, and Chipotle itself jumped into the category in December 2013 with Denver-based Pizzeria Locale (pizzerialocale.com).

“There are a lot of companies vying for position right now,” observes John Arena, co-owner of the five-store Metro Pizza (metropizza.com) in Las Vegas. “Two years ago, everyone was saying, ‘I’m going to be the Chipotle of pizza.’ Well, now, as it turns out, Chipotle is going to be the Chipotle of pizza with Pizzeria Locale. In the end, there will be only two or three major players.”

For now, though, the field is packed with competitors. Blaze Pizza (blazepizza.com) opened its 40th store in early October and has commitments to open 315 company-owned and franchised units in 33 states and Washington, D.C. Meanwhile, Pie Five Pizza has 26 franchises, while Uncle Maddio’s Pizza Joint (unclemaddios.com) lays claim to 25 stores and PizzaRev touts 19 locations. Other leaders include Pieology (pieology.com) with 35 stores, Mod Pizza (modpizza.com) with 23, and Your Pie (yourpie.com) with 21. San Diego-based Project Pie (projectpie.com) was the first to expand overseas, opening six stores in the Philippines over the last two years in addition to its seven stores in the U.S.

| COMPARING 2014 AND 2013 SALES FIGURES |

| While compiling last year’s Pizza Power Report, we found our industry sources—such as CHD Expert, Euromonitor and Technomic—didn’t always agree on sales growth. For example, CHD Expert showed a decline in 2013’s total pizza restaurant sales, while Euromonitor showed some growth in North America for 2013, and Technomic’s figures indicated higher sales for the top chains for 2012. In the end, we opted to split the difference between the conflicting reports and arrived at our own estimates showing positive growth in total pizza restaurant sales of 1.16% in 2013.

Since all of our sources for this year’s reports agree that the industry saw positive growth over the past year, we will stick with CHD Expert’s figures for overall pizza restaurant sales and forgo making our own estimates. However, it was necessary to compare certain figures from this year to PMQ’s estimated figures from the previous year |

Buxton, a customer analytics firm, reports that Millennials are particularly captivated by fast-casual pizza because it’s relatively low-priced—typically between $8 and $10 per meal—and made to their specifications. Restaurants in this category also make smart use of social media in their marketing strategies, appealing to younger consumers who live and die by their mobile devices. Strapped for cash, tech-savvy and always in a hurry, Millennials “want what they want when they want it,” a Buxton study found. “Millennials want to be active co-creators; they want to interact with brands and interact with their food—which is the exact model of fast-casual pizza concepts.”

Fast-casual is “a service style that speaks to a particular generation and a demographic that everyone wants to reach,” Arena agrees. “It’s a concept based on a system more than a particular food, and, if you can make it work with your food niche, it resonates with young people. That service style of building to order lends itself to the ‘I’m special’ mindset. It’s a phenomenon I call ‘let’s all be different together.’”

Still, Jay Jerrier, owner of Cane Rosso (ilcanerosso.com) and Zoli’s NY Pizza (zolispizza.com) in Dallas, believes the fast-casual bubble will burst soon enough. “I think there are 10 or 11 opening in Dallas right now,” he says. “There’s no way they can all survive.” The concept wouldn’t work for him anyway, Jerrier adds. “I have zero interest in propagating that high-volume model. I can price my pizzas at six dollars, but now I’ve got to sell a thousand of them before it gets interesting. Why would you want to do that? I’ll let someone else have that crazy lunch business and make all my money at dinner and on the weekends, when people don’t want to go to those places.”

Better Pizza, Local Ingredients

|

|

High-quality ingredients and authentic Neapolitan pizza are hallmarks of Jay Jerrier’s Cane Rosso concept, with four stores in the Dallas area. Photo by Emily Loving. |

The proliferation of fast-casual pizza concepts proves that affordability and convenience are major factors in the consumer’s dining decision. But many customers are still quite picky about quality, and artisanal pizza with premium ingredients maintains a strong appeal. According to Technomic, more customers now opt for nontraditional pizza ingredients, such as mushroom sauce, provolone, steak and pineapple. Forty-three percent say they like their preferred pizza restaurant because it uses high-quality, fresh ingredients, and 64% say they want more pizzerias to offer premium ingredients.

For many consumers, local sourcing has become synonymous with quality. “Today’s consumers are preoccupied with fresh and locally sourced foods as identifiers of both high-quality and ‘better for you’ fare,” writes Technomic president and CEO Ron Paul in the August 2014 issue of his company’s Foodservice Digest newsletter.

“Just as ‘fresh’ has many meanings…‘local’ is a word with a multitude of implications. It may imply freshness, quality, exclusivity, artisanal character, sustainability, and socially responsible interactions with suppliers and processors.”

Paul says restaurants are moving toward “radical transparency to help diners identify and choose foods and beverages that are not only local and sustainable but also less processed, with fewer and more recognizable ingredients.”

Jerrier puts it more bluntly. “People don’t necessarily want some generic commodity rabbit-turd sausage,” he says. “I can find a chef in town that makes really good sausage for me, or I can make it myself. Customers want to understand the provenance of where their food comes from. You’re going to see a lot more thoughtful sourcing from pizzerias. It’s a big thing for us in the pizza business.”

The Neapolitan Evolution

With four locations in the Dallas area, Jerrier’s Cane Rosso specializes in Neapolitan pizza, one of the driving forces behind both the better-pizza movement and the fast-casual trends. Prepared according to strict rules enforced by organizations like the Associazione Verace Pizza Napoletana (VPN) and the Associazione Pizzaiuoli Napoletani (APN), authentic Neapolitan pizza provides a true Italian pizza experience, often using top-shelf ingredients imported from Italy.

Despite the conservative traditions of Neapolitan pizza making, Arena thinks some purists have begun to “spread their wings a little bit.” They’re still sticking with the required ingredients and processes but have begun to tinker with the minimalist formula, he believes. “I think the lines are going to get blurred over time,” Arena adds. “There’s more creativity going on. I think the guys that have been in it for a while are bending the rules. After you’ve been doing something for a long time, you kind of want to do your own thing. I think that’s human nature.”

Jerrier notes that VPN rules deal chiefly with preparation of the dough and the cooking method. “They are focused on the foundation,” he says. “So all we are doing is taking the foundation of VPN pizza and experimenting with interesting topping combinations. VPN doesn’t care if we put smoked brisket or even ham and pineapple on a pizza. You can be VPN-certified and get as creative as you’d like with the toppings. If you switch to a gas or electric oven and start using a dough sheeter, they may have a problem with that.”

But after years of steady growth and media hype, has Neapolitan pizza finally peaked? Jerrier says it’s hard to tell. “It went through such a crazy spurt over the past few years that, on the one hand, you think it can’t be sustainable,” he notes. “But what we’re seeing is the growth of Neapolitan-style offshoots, primarily in the fast-casual category. 800 Degrees (800degreespizza.com) really pioneered the concept, but now you have all of these copycats trying to replicate what they think is a ‘hot concept.’ They’re trying to make a 75-second pizza ‘better, faster and cheaper.’ There is no way they can all survive.

To Your Health

|

|

Many consumers today care deeply about where their food comes from, and environmentally conscious pizzerias like Earth Bread + Brewery in Philadelphia make every effort to find local sources for key ingredients. Photo by Alix Passage. |

Gluten abstinence may have already peaked, but demand for gluten-free products remains strong. According to a survey conducted in May by NPD Group, 29.4% of respondents said they are trying to avoid gluten, a slight decrease from a peak of more than 30% in late 2013, but still higher than the 25.5% figure measured in 2010.

Regardless, when nearly one-third of the population shares a dietary aversion, restaurant operators must take notice. That’s why many pizzerias are adding gluten-free offerings to their menus, even though only about 1% of the overall population has celiac disease. Others consider themselves gluten-sensitive, while another segment perceives gluten-free as a healthier alternative to standard crusts. The jury’s still out on the exact cause of gluten sensitivity—or whether gluten is really the culprit in some cases—but that hasn’t stopped the major chains and many smaller operators from capitalizing on the anti-gluten craze. There’s a gluten-free pizzeria in nearly every state now, and many operators offer delivery of their gluten-free pies.

Accommodating pizza lovers who have gluten issues is one thing, but Arena warns against building your business model entirely around gluten-free offerings. “The people I talk to about gluten-free are doing it as a lifestyle choice, not for medical reasons,” he says. “They’re convinced they feel better. But they’re the same customers who thought they were lactose-intolerant a few years ago.” In other words, although celiac disease is a serious medical issue, those who reject gluten by choice may change their minds over time.

“Lifestyle choices come and go,” Arena says. “If you’re planning on retooling your restaurant for gluten-free, you may not realize a return on your investment before it peaks and goes away. Will those restaurants still be around 25 years from now? I don’t know. I don’t think so.”

In fact, Technomic finds that fewer consumers worry about their health or their waistlines when they go out for pizza these days. Only 22% say they rein in their pizza cravings due to health concerns, down from 28% in 2012. Moreover, just 34% of today’s diners say they want pizzerias to offer healthier pizzas, a decrease from 40% in 2012.

Even so, Technomic notes, “better-for-you qualities still resonate” with pizza customers. That’s why we’re still seeing innovations such as the “Skinny Slice” pies that Pizza Hut (pizzahut.com) rolled out this fall in Toledo, Ohio, and West Palm Beach, Florida. Made with less dough and fewer toppings, these pies boast a calorie count of 300 or less. Hungry Howie’s (hungryhowies.com) cracker-thin crust also keeps the calorie count down—two slices of a medium thin-crust cheese pie come in at 222 calories. And fast-casual leader PizzaRev brought back its seasonal lower-calorie PizzaRes-Olution last January. Made with a thin and crispy dough, reduced-fat buffalo-milk mozzarella and veggie toppings, it can be crafted for under 650 calories, according to the company.

The takeaway? It still pays to feature some healthier, lower-calorie options, including vegetarian and vegan items. Better menu variety makes all customers feel welcome.

How to Compete

| Restless Palate Syndrome |

| Baum + Whiteman, an international food and restaurant consulting firm, recently coined the phrase “restless palate syndrome” to describe Americans’ changing tastes. Here are some of the firm’s predictions for food trends in 2015:

1. Ugly root vegetables rule. More chefs are experimenting with celery root, parsnips and kohlrabi to create unique and flavor-packed signature recipes. 2. Seaweed’s outta sight. Chefs are quietly spiking their poaching broths, seafood sauces and even risotto with seaweed for its 3. Honey’s getting hotter. Sweet-and-spicy is all the rage—think habanero honey, jalapeño honey and ghost chili honey. Paulie Gee’s (pauliegee.com) in Brooklyn, for example, earned press coverage last fall for its spicy Hellboy pizza, featuring Mike’s Hot Honey. 4. Hummus on the rise. Hummus may dethrone salsa as the side of choice—Subway even tested it as a meat-free sandwich topping. 5. Bye-bye, bacon. Americans’ obsession with bacon seems to have abated, but we still love our pig meat. Customers want more guanciale, pancetta and ‘nduja, a spicy, spreadable Calabrian sausage that The New York Times once described as “the Lady Gaga of pork products.” |

Feeling nervous about all this competition from the burgeoning fast-casual segment? Technomic’s Pizza Consumer Trend Report has a couple of suggestions for holding on to your market share, starting with delivery. Since fast-casual pizzerias typically don’t deliver, this can be a key point of differentiation for your restaurant. According to Technomic, only 23% of consumers say they never order delivery for pizza. Delivery is “a stronger driver of repeat patronage and loyalty than either fast service or low prices,” the report states.

You may even be able to pass a delivery charge onto your customers. Thirty-five percent of consumers in the Technomic report said they would be willing to pay a delivery fee for their favorite pie. That number is actually down from 38% in 2012, but the good news is that 45% of pizza-loving Millennials don’t mind paying that delivery fee—and they are the future of your business.

Younger customers also prefer to place their pizza orders digitally. Telephone orders are falling, Technomic reports—just 55% of customers now typically order pizza by phone compared to 64% in 2012. Instead, more of them—especially Millennials and those aged 35 to 44—prefer to order via computer, mobile device or ordering app. “Digital ordering platforms can keep brands relevant and top-of-mind,” the Technomic report says. “In fact, 18% cite convenient ordering options as one of the top three reasons they order from their primary pizza location most often, indicating that online or mobile ordering could prompt a choice of one brand over another.”

Finally, there’s social media. If your pizzeria doesn’t at least have a Facebook page—and, preferably, a Twitter account—by now, well, frankly, we’re flummoxed. Simply put, social media is a must for marketing to customers young and old alike. It has been essential to the growth of those trendy fast-casual stores that are moving into your neighborhood right now, and if you’re ignoring it, you’re probably making a big mistake. Millennials in particular use a range of social media platforms to tell the world what they’re doing every minute of the day, and they spend a lot of time in restaurants. In fact, NPD Group reports that Millennials made more than 14 billion visits to foodservice establishments and spent $95 billion on restaurant meals and snacks in the year ending June 2014. “Their use of social media in sharing dining experiences and their opinions of these experiences make Millennials highly influential in building—or hurting—a restaurant brand,” NPD Group states in an October 28 press release.

Adds NPD Group restaurant industry analyst Bonnie Riggs, “What Millennials lack in buying power, they make up for in influence. They have expectations when they dine out and are quick to spread the word when their expectations are or aren’t met.”

An Uncertain Future

Whatever may happen in the pizza restaurant business in 2015, one thing’s for certain: Nothing is for certain. Big fat question marks loom over the industry, and when answers come—if they come at all—they may be fuzzy. Everyone’s talking about the fast-casual movement, local sourcing and healthier ingredients, but perhaps what they should really be talking about are the rising costs of running a pizza business in the coming year. Between soaring commodity prices, the Affordable Care Act, and proposed hikes in the minimum wage at local and state levels, serving the world’s most popular food may soon become a more expensive proposition than it’s ever been.

“It’s the perfect storm,” Arena says. “I think people have been in denial, but it’s coming. With the more perceptive operators, there’s a little bit of apprehension in the air.”

At present, the Affordable Care Act’s employer mandate won’t kick in until 2016 for midsize companies with between 50 and 99 full-time employees. Pizza companies with 50 or more full-time employees will be required to provide healthcare insurance to those employees by that time. Those with 100 or more full-time employees will have to start providing health benefits to at least 70% of their employees by 2015, and to 95% of them by 2016.

|

|

Although the cost of running a pizza business will almost certainly go up in 2015, pizza will remain the world’s most popular communal food. |

“Let’s say your pizzeria employs 25 people,” Arena says. “Are you going to open a second store once you know it will put you over 50 employees and that each employee will cost you $3,000 more a year? For a company like mine that has 200 employees, that’s $600,000. I don’t have a spare $600,000 lying around at the end of the year.”

Meanwhile, pork and chicken prices keep going up, and the minimum wage will also be on the rise in a number of cities and states. “Add in insurance, taxes, and the bump that your non-minimum-wage employees will expect, and it becomes imperative to start planning now,” Arena says.

So how will Metro Pizza deal with the challenges of rising costs in 2015? “We’re going to increase our prices,” Arena says, flatly. “I think we’ll need our per-person check average to go up about a dollar. That’s basically about a 9% or 10% increase. We plan to do it before January. You can’t wait until you’ve already been impacted [by rising costs] and then try to play catchup. If you’re not raising your prices now, you will raise them if you’re a company with more than 49 employees. There’s no getting around it.”

In turn, higher prices could scare some customers away, Arena admits. “I don’t think they’ll stop eating pizza, but there may be less frequency. If a family eats at my restaurant three times a month, maybe they cut back to twice a month. That’s a big hit for me.”

But the prognosis for 2015 isn’t all doom and gloom. The one sure thing is that Americans will keep eating pizza. Even high-end pizza will remain affordable, and pizza will likely continue to be a must-have comfort food, in an era when we need all the comfort we can get. “People are, by nature, communal, and pizza is the world’s greatest communal food,” Arena says. “War in Afghanistan? Global warming? Riots in the heartland? Ebola in Dallas? Hunker down with your loved ones and share a pizza. The problems may not disappear, but at least you won’t be alone when the zombie apocalypse begins.”